history of banking

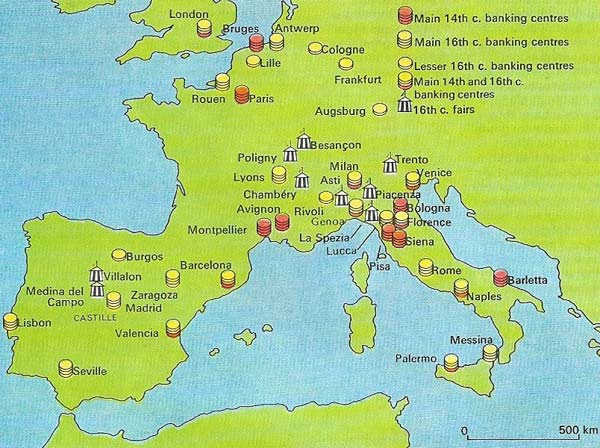

Figure 1. Bruges, whose financial activities were dominated by Italians, was the only permanent medieval banking center outside Italy. The late 15th century witnessed the rise of the south German houses. The major 16th-century centers were Antwerp, Lyon’s and the seasonal fairs on Castile and at Besancon. The Genoese controlled the Besancon fairs which soon left and reconvened in Piacenza by 1570.

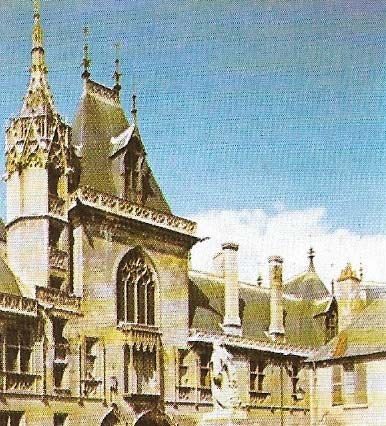

Figure 2. Jacques Coeur (c. 1395–1456), French merchant, moneylender and financier. Built this palace in Bourges during his spectacular career. He lost his fortune in 1453 and was exiled until his death.

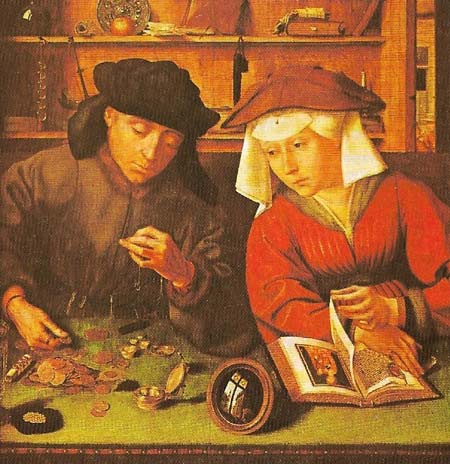

Figure 3. This painting by Quentin Massys (c. 1465–1530) shows the money-changer and his wife at work. For a small fee they would exchange gold for silver coins or the coins of one currency into another.

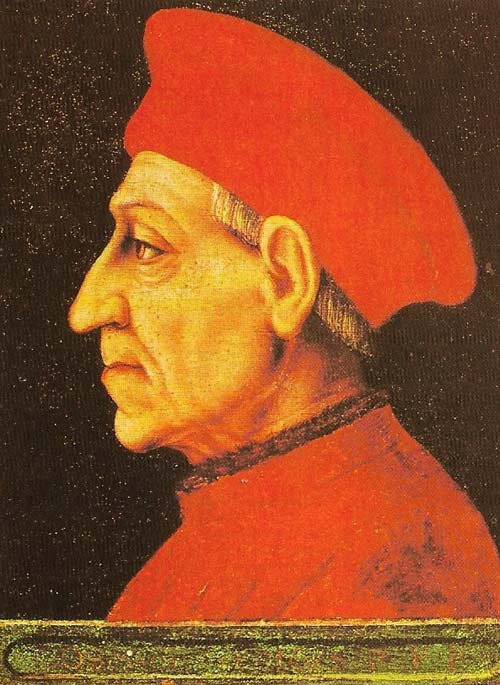

Figure 4. The Medici family were the greatest of all 15th-century Italian bankers with branches in France, England, the Low Countries and Italy. Under Cosimo de Medici (1389–1464), like his successors a patron of the arts, they reached the peak of their influence and wealth. Already in serious financial trouble, the firm finally foundered when the Medici were expelled from Florence in 1494.

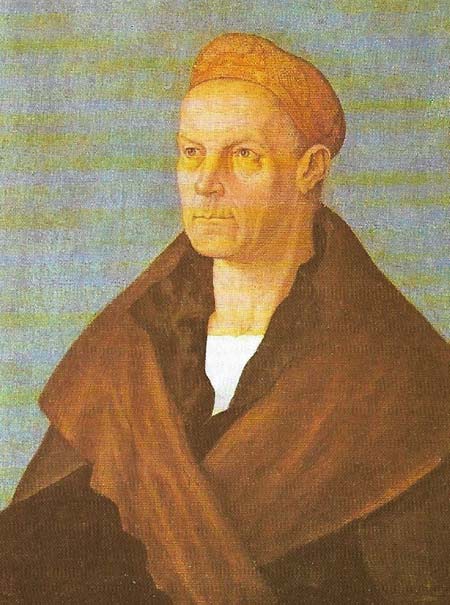

Figure 5. In the early 16th century the Europe-wide commercial and financial empire of the Augsburg family, Fugger was the largest western world had ever seen. It rested on lucrative mining monopolies, extensive trade and loans on a vast scale. The most spectacular period occurred under the guidance of Jakob Fugger the Rich (1459–1525) (here painted by Albrecht Durer). He learnt the banking trade in Italy.

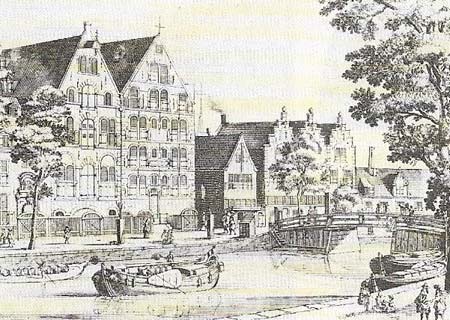

Figure 6. The Amsterdam Exchange Bank (1609) was one of the most successful of the municipally supervised banks set up after the financial recovery of the late 16th century. It received cash deposits of over 300 Florian, transferred money between customers' accounts, traded in bullion and handled all bills of exchange over 600 florins. Like other municipal banks it did not make loans, grant overdrafts or discount bills nor did it issue banknotes.

Figure 7. The form of the bill of exchange altered little from its evolution in the 14th century. To avoid the Church's prohibition on usury it had to instruct the recipient in another country to make payment in another currency to the person specified. Usually the rate of exchange was given. This bill, signed by Anton Fugger, required the Fugger agents in Rome to pay 2,700 ducats to the Dean of Elwagen.

Between the 12th and the 15th centuries Italy exercised a European supremacy in commerce and finance and was responsible for most innovations in business and banking. By the sixteenth century that supremacy was being eroded. In twelfth-century Genoa, banks accepted deposits, exchanged foreign coins for local currency and engaged in bullion dealing. Later the Florentines became the leading Italian bankers. Throughout this period banking and trade were invariably combined and the commercial contacts of the Italians throughout Europe necessitated the regular international transfer of money. The simple but commercially important bill of exchange (Figure 7) was evolved in the fourteenth century and avoided the problems and dangers of transporting gold and silver coins.

Activities of medieval bankers

Largely as a consequence of the Church's ban on lending money for interest (usury), medieval bankers made exchange operations a key activity. Although the bill of exchange did involve a credit element until the money was paid out at a later date, it was not classified as a loan.

The banker's profit came from the exchange rate – the Medici averaged 15 percent. The prohibition on charging interest may also have impeded the evolution of the basic banking activities of borrowing and lending at interest, although deposit banks did exist, mainly in Italy, but also in Bruges (Figure 1). They offered non-interest bearing current accounts and the facility of making transfers between customers' accounts.

From the 14th century onwards some towns allowed written orders (the distant ancestor of the check) to make payments or transfers. These orders replaced the original requirement that such orders had to be made orally by the depositor in person.

A decline in private banking in the Low Countries and Italy in the fifteenth century is illustrated by the fall in numbers of large Florentine banks from 80 to eight between 1330 and 1526. The hazards of medieval banking are revealed in an assertion made in 1585 that over the years 96 out of 103 Venetian banks had failed, often through incautious loans to merchants and governments. Deposit banking recovered in the late sixteenth century, often in the form of municipally controlled public banks, as in Venice and later in Amsterdam (Figure 6), both of which accepted deposits and transferred money between customers' accounts.

|

| The Papacy received dues and taxes from all over Europe. Heedless of the usury prohibition, the Papacy also borrowed at interest from bankers, the great basilica of St Peter's, begun the really 16th century, was partly financed by the proceeds from the sale of indulgences conveyed by the Fuggers, who had broken the Italian monopoly.

|

Small banks and money-lenders

More widespread than the handful of great Italian merchant banks such as the Medici (Figure 4) were small local banks. These shared many of the functions of their large counterparts, accepting deposits, making loans on pledges and changing money, but avoided exchange and transfer operations.

Throughout Europe there were also the reviled but necessary money-lenders and pawnbrokers who made small, short-term loans to the poor. Even in a largely subsistence peasant economy, money was needed to pay taxes and the poorest might seek a loan in hard times. Some of these money-lenders were Christians, but most were Jews to whom the usury laws did not apply and who could therefore charge interest. Some, such as those in Florence in 1437, were officially invited to set up licensed pawnshops so that Christian souls should not be jeopardized through usury, although Christian money-lenders were not above charging disguised interest.

|

| Aaron, a noted Jewish usurer, built this house in Lincoln in about 1170–1180. He conducted business with the greatest families of England and financed part of the building of Canterbury Cathedral. On his death a special department of the Exchequer had to wind up his huge financial assets, the Jews were expelled from England in 1290, as the king hoped to take over their assets and debts from the nobility.

|

In mid-15th-century Italy churchmen established non-Jewish pawnshops, the Monti di Pieta, to meet the needs of the poor. The charitable purpose of these pawnshops was perverted, however, when governments and the rich turned to them for loans.

Sixteenth-century banking

The 16th century saw no major innovations in banking practices but, as the European economy expanded, the scale of operations increased, credit became more extensive and other nationalities, especially the south Germans, adopted Italian methods. London remained a second-rank financial center until the late seventeenth century. Methods of obtaining credit became more flexible as a result of the increasing use of endorsement and discounting, although until the seventeenth century these were rarely applied to bills of exchange. Interest rates fell and some Protestant states adopted a more liberal attitude towards usury. Expanding trade was facilitated by the evolution of an unofficial system of settling international trading debts and balances during the great seasonal European trade fairs. This lasted until the late 16th century when the fairs began to lose their importance.

The most spectacular development was the mid-16th-century boom in government borrowing to meet the escalating costs of war. The French kings raised money in Lyons, the English and Spanish rulers in Antwerp, the greatest center for long-distance trade of the era. Fortunes were lost as the kings of France and Spain defaulted on their debts, just as Edward III of England had ruined two Florentine banks in the 1340s. Ordinary individuals as well as great banks such as the south German Fuggers (Figure 5) were hit. Although the Fuggers survived on a reduced scale, by the end of the 16th century the era of the international financier was over, although more mundane forms of banking continued to prosper and develop.

|

| Jakob Fugger's most famous loan was made to the Hapsburgs: 543,585 Florian's that helped to buy the votes of the Imperial Electors who mad Charles V of Spain Holy Roman Emperor in 1519. The fortunes of the Fuggers and the Hapsburgs were thereafter closely linked, Charles V had to borrow unprecedentedly large sums from foreign bankers living in Antwerp to pay for his wars with the French, the Turks and the German Protestants.

|